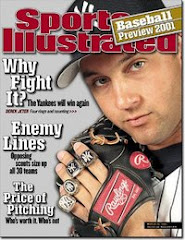

New York state tax officials want Derek Jeter to pay hundreds of thousands -- possibly even millions of dollars -- in back taxes and interest for the years 2001 to 2003, when he claimed Florida residency despite spending the bulk of his time in New York.

An administrative judge's ruling shows that Jeter has claimed Florida residency since 1994. New York state isn't going back that far, but it does want it's cut from Jeter's check from after be bought a $13 million apartment in Manhattan. Jeter made $34 million in salary from 2001 through 2003 and likely millions more in endorsements.

Source: FOXNews.com

Unless there is some kind of mix up, Derek jeter did a big no no . never screw with the government. I know this whole story doesn't sound like something the captain would do but i guess hes not as much of a saint as everybody makes him out to be. First the whole herpes thing now hes screwing around with taxes.Maybe that's why he sucked this year in the post season,he was probably thinking about the extra $$ he made and how hes going to spend it on his next super model girlfriend. Jete I'm just messing with you and i love you just keep it clean

2 comments:

This is completely ridiculous. I'm sure there are plenty of players that pull off the same deal. NY State is pushing their jurisdiction too far.

Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not have state income taxes. (New Hampshire and Tennessee also limit their state income taxes to only dividends and interest income).

This why so many players like to list their homes as being in Florida or Nevada. Jeter's not the only player to do this. The question is, how many other players will state officials go after? Probably none.

Someone in Albany is trying to beef up their resume and Jeter was an easy target. If Derek is smart, he'll pay up and not try and fight this any more. There's no way for him to win on this one.

Post a Comment